Basics for a Strategy

import datetime

import pandas as pd

import pandas.io.data

from pandas import Series, DataFrame

import matplotlib.pyplot as plt

import matplotlib as mpl

import matplotlib.ticker as mticker

import matplotlib.dates as mdates

from matplotlib import style

import numpy as np

import time

style.use('ggplot')

def outlier_fixing(stock_name,ma1=100,ma2=250,ma3=500,ma4=5000):

df = pd.read_csv('X:/stocks_sentdex_dates_short.csv', index_col='time', parse_dates=True)

print df.head()

df = df[df.type == stock_name.lower()]

std = pd.rolling_std(df['close'], 25, min_periods=1)

print std

df['std'] = pd.rolling_std(df['close'], 25, min_periods=1)

df = df[df['std'] < 17]

MA1 = pd.rolling_mean(df['value'], ma1)

MA2 = pd.rolling_mean(df['value'], ma2)

MA3 = pd.rolling_mean(df['value'], ma3)

MA4 = pd.rolling_mean(df['value'], ma4)

ax1 = plt.subplot(3, 1, 1)

df['close'].plot(label='Price')

ax2 = plt.subplot(3, 1, 2, sharex = ax1)

MA1.plot(label=(str(ma1)+'MA'))

MA2.plot(label=(str(ma2)+'MA'))

MA3.plot(label=(str(ma3)+'MA'))

MA4.plot(label=(str(ma4)+'MA'))

ax3 = plt.subplot(3, 1, 3, sharex = ax1)

df['std'].plot(label='Deviation')

plt.legend()

plt.show()

#outlier_fixing('btcusd',ma1=100,ma2=2500,ma3=5000,ma4=50000)

def single_stock(stock_name,ma1=100,ma2=250,ma3=500,ma4=5000):

df = pd.read_csv('X:/stocks_sentdex_dates_full.csv', index_col='time', parse_dates=True)

print df.head()

df = df[df.type == stock_name.lower()]

MA1 = pd.rolling_mean(df['value'], ma1)

MA2 = pd.rolling_mean(df['value'], ma2)

MA3 = pd.rolling_mean(df['value'], ma3)

MA4 = pd.rolling_mean(df['value'], ma4)

ax1 = plt.subplot(2, 1, 1)

df['close'].plot(label='Price')

ax2 = plt.subplot(2, 1, 2, sharex = ax1)

MA1.plot(label=(str(ma1)+'MA'))

MA2.plot(label=(str(ma2)+'MA'))

MA3.plot(label=(str(ma3)+'MA'))

MA4.plot(label=(str(ma4)+'MA'))

plt.legend()

plt.show()

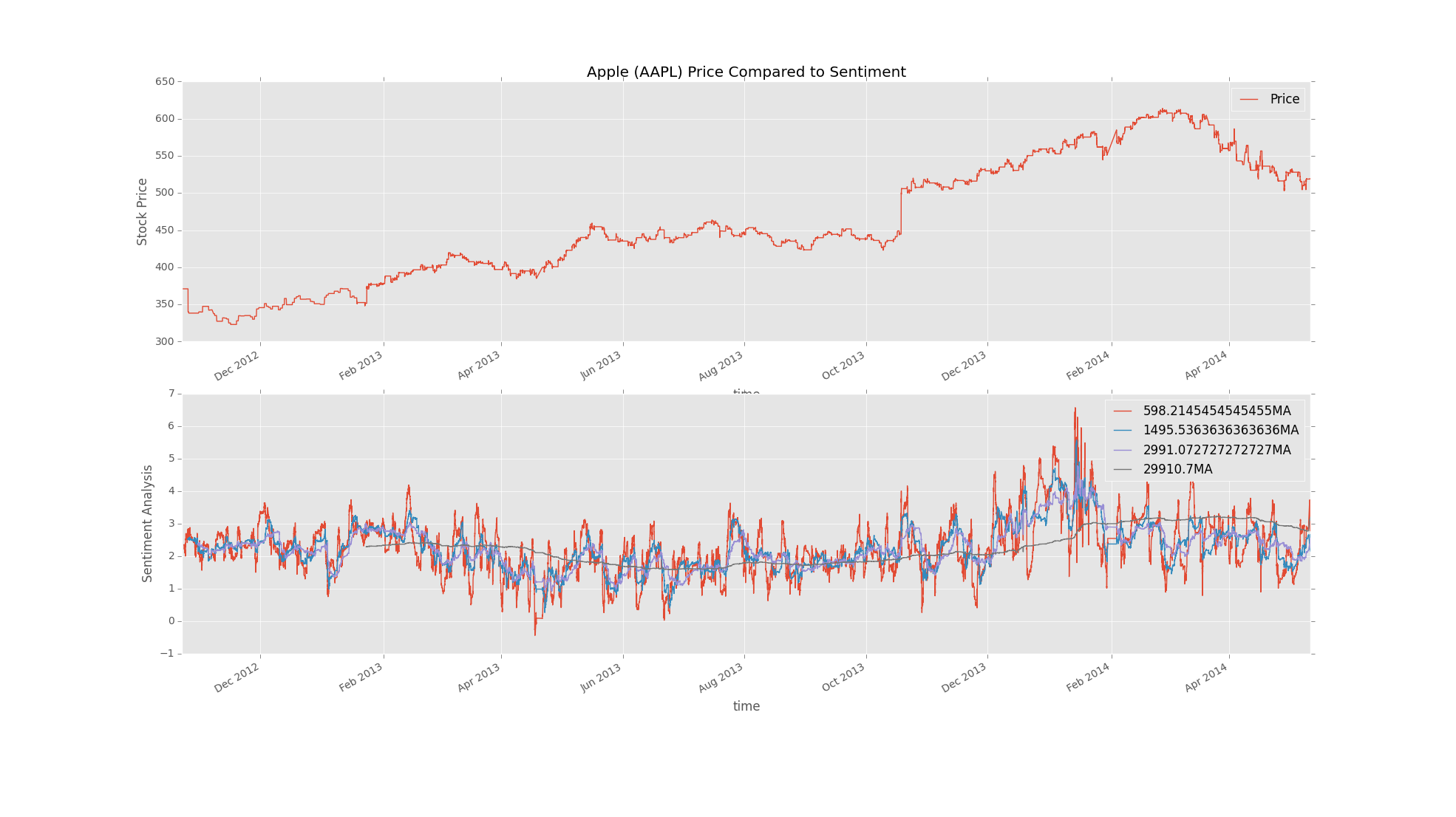

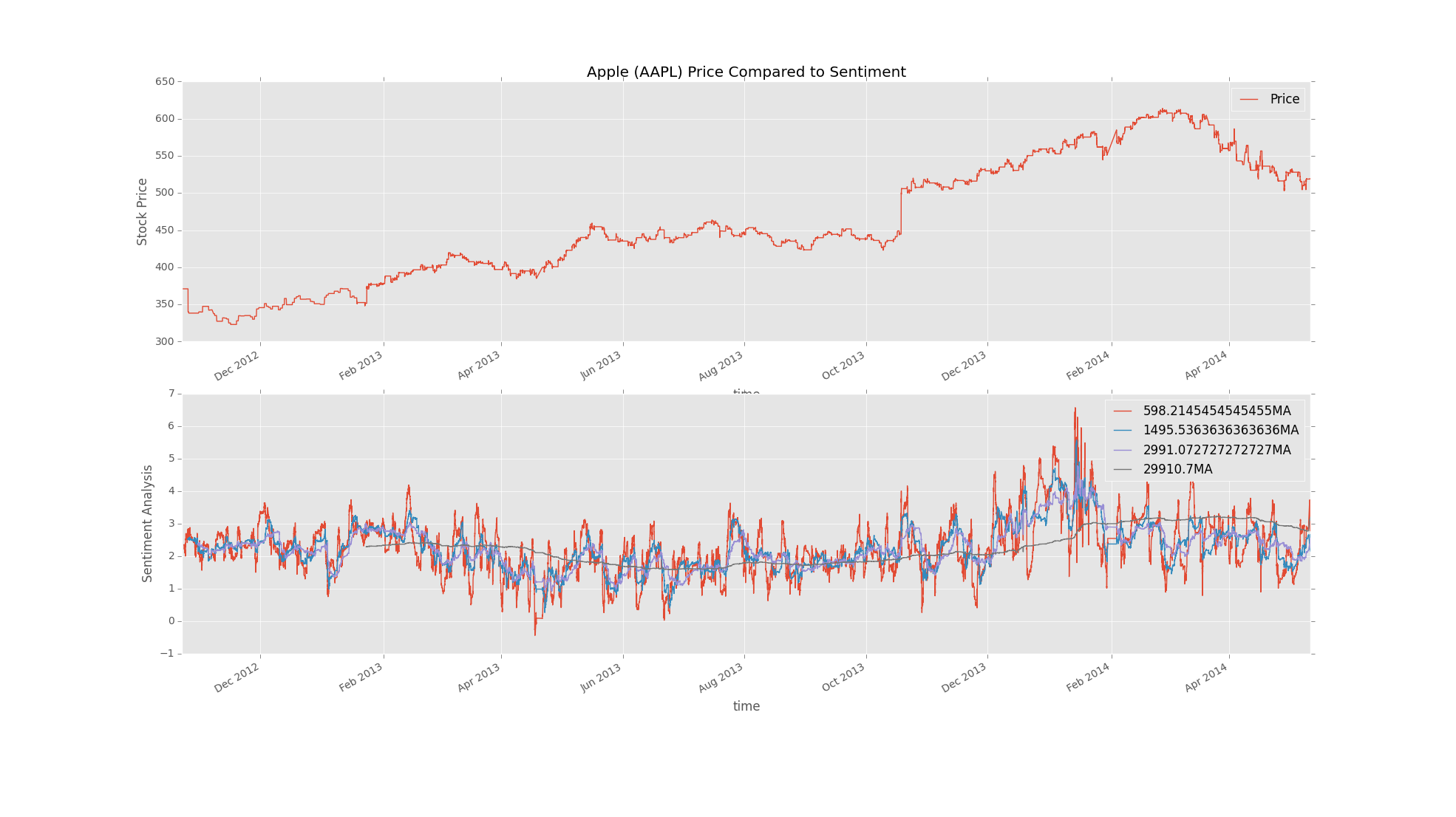

def single_stock_auto_MA(stock_name):

df = pd.read_csv('X:/stocks_sentdex_dates_full.csv',

index_col='time', parse_dates=True)

print df.head()

df = df[df.type == stock_name.lower()]

print '----'

count = df['type'].value_counts()

print 'trying:'

count = int(count[stock_name])

MA1 = pd.rolling_mean(df['value'], (count/275))

MA2 = pd.rolling_mean(df['value'], (count/110))

MA3 = pd.rolling_mean(df['value'], (count/55))

# because we use a decimal here, and we're using py 2.7, this will

# create a float as opposed to the others that will create an int

MA4 = pd.rolling_mean(df['value'], (count/5.5))

ax1 = plt.subplot(2, 1, 1)

df['close'].plot(label='Price')

plt.ylabel('Stock Price')

plt.legend()

plt.title('Apple (AAPL) Price Compared to Sentiment')

ax2 = plt.subplot(2, 1, 2, sharex = ax1)

MA1.plot(label=(str(count/275)+'MA'))

MA2.plot(label=(str(count/110)+'MA'))

MA3.plot(label=(str(count/55)+'MA'))

MA4.plot(label=(str(round((count/5.5), 1))+'MA'))

plt.ylabel('Sentiment Analysis')

plt.legend()

plt.show()

#single_stock_auto_MA('c')

single_stock_auto_MA('goog')

#single_stock_auto_MA('aapl')

The next tutorial: