Programming for Finance Part 2 - Creating an automated trading strategy

Algorithmic trading with Python Tutorial

We're going to create a Simple Moving Average crossover strategy in this finance with Python tutorial, which will allow us to get comfortable with creating our own algorithm and utilizing Quantopian's features. To start, head to your Algorithms tab and then choose the "New Algorithm" button. Here, you can name your algorithm whatever you like, and then you should have some starting code like:

# Put any initialization logic here. The context object will be passed to

# the other methods in your algorithm.

def initialize(context):

pass

# Will be called on every trade event for the securities you specify.

def handle_data(context, data):

# Implement your algorithm logic here.

# data[sid(X)] holds the trade event data for that security.

# context.portfolio holds the current portfolio state.

# Place orders with the order(SID, amount) method.

# TODO: implement your own logic here.

order(sid(24), 50)

As you can see, some initial code has been prepared for us.

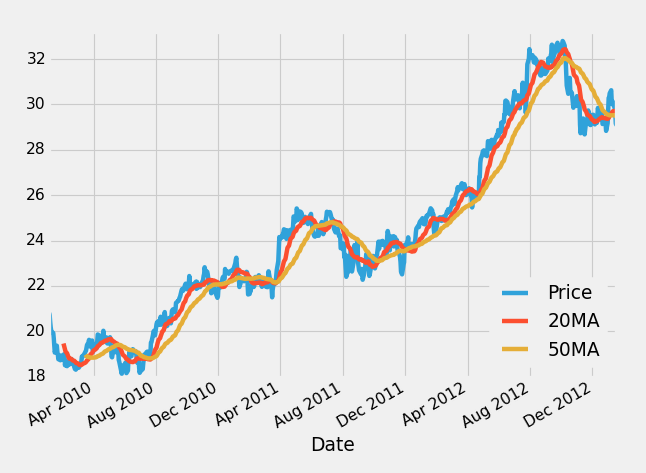

If you're not familiar with moving averages, what they do is take a certain number of "windows" of data. In the case of running against daily prices, one window would be one day. If you took a 20 moving average, this would mean a 20 day moving average. From here, the idea is let's say you have a 20 moving average and a 50 moving average. Plotting this on a graph might look something like:

Here, the blue line is the stock price, the red line is the 20 moving average and the yellow line is the 50 moving average. The idea is that when the 20 moving average, which reacts faster, moves above the 50 moving average, it means the price might be trending up, and we may want to invest. Conversely, if the 20 moving average falls below the 50 moving average, this signals maybe that the price is trending down, and that we might want to either sell or investment or even short sell the company.

Looking at the graph above, it looks to us like we'd do pretty well. We miss the absolute peaks and troughs of the price, but, overall, we think we'd do alright with this strategy.

Every time you create an algorithm with Zipline or Quantopian, you will need to have the initialize and handle_data methods. They should be included in every algorithm you start new.

The initialize method runs once upon the starting of the algorithm (or once a day if you are running the algorithm live in real time). Handle_data runs once per period. In our case, we're running on daily data, so this means it will run once per day.

Within our initialize method, we usually pass this context parameter. Context is a Python Dictionary, which is what we'll use to track what we might otherwise use global variables for. Context will track various aspects of our trading algorithm as time goes on, so we can reference these things within our script.

Within our initialize method:

def initialize(context):

context.security = symbol('SPY')

What this does, is it sets our security for trading to the SPY. This is the Spyder S&P 500 ETF (Exchange Traded Fund), which is a method that we can use to trade the S&P 500 index.

That's all we'll do for now in our initialize method, next we will begin our handle_data method:

def handle_data(context, data):

MA1 = data[context.security].mavg(50)

MA2 = data[context.security].mavg(200)

Notice here that we pass context and a new parameter called data. Data tracks the current data of companies within our "trading universe." The universe is the collection of companies we're plausibly interested in maybe investing into. In our case, we set this universe at the beginning in the initialize method, setting our entire universe to the SPY.

Put simply, the context var is used to track our current investment situation, with things like our portfolio and cash. The data variable is used to track our universe of companies and their information.

.mavg() is a method built into Quantopian, and "data[context.security]" is us referencing the key by this name in our context dictionary.

We could call these context.MA1 and context.MA2 if we wanted to store these to our context dictionary and use it outside of our handle_data method, but we do not need to access this data outside of here, so we'll just make them local variables.

Now that we have the moving averages calculated, we're ready for more logic. In order to trade, we need to have logic like if the MAs have crossed over, but also, before we can make a trade, we need to see if we have enough money to make a purchase, we need to know the price of the security, and we should check to see if we already have this position. To do this, we add the following to our handle_data method:

current_price = data[context.security].price

current_positions = context.portfolio.positions[symbol('SPY')].amount

cash = context.portfolio.cash

We grab current price by referencing data, which is our way of tracking our universe of companies (currently just the S&P 500 ETF $SPY). Next, we check to see any current positions that we have by referencing our context.portfolio. In here, we can reference all sorts of things in regards to our portfolio, but, right now, we just want to check our positions. This returns a dictionary of all of your positions, the amount, how much has been filled, and so on. So we're interested in a specific position in a company, so we do context.portfolio.positions[symbol('SPY')]. From here, our only concern right now is to just see if we have any investment at all, so the attribute we care about most is the amount of positions we have, so we use .amount at the end.

Up to now, we've created the information required for us to know before we actually use some logic to execute trades, but we haven't written anything to actually do the trading. That's what we're going to cover in the next tutorial.

There exists 2 quiz/question(s) for this tutorial. for access to these, video downloads, and no ads.

-

Programming for Finance with Python, Zipline and Quantopian

-

Programming for Finance Part 2 - Creating an automated trading strategy

-

Programming for Finance Part 3 - Back Testing Strategy

-

Accessing Fundamental company Data - Programming for Finance with Python - Part 4

-

Back-testing our strategy - Programming for Finance with Python - part 5

-

Strategy Sell Logic with Schedule Function with Quantopian - Python for Finance 6

-

Stop-Loss in our trading strategy - Python for Finance with Quantopian and Zipline 7

-

Achieving Targets - Python for Finance with Zipline and Quantopian 8

-

Quantopian Fetcher - Python for Finance with Zipline and Quantopian 9

-

Trading Logic with Sentiment Analysis Signals - Python for Finance 10

-

Shorting based on Sentiment Analysis signals - Python for Finance 11

-

Paper Trading a Strategy on Quantopian - Python for Finance 12

-

Understanding Hedgefund and other financial Objectives - Python for Finance 13

-

Building Machine Learning Framework - Python for Finance 14

-

Creating Machine Learning Classifier Feature Sets - Python for Finance 15

-

Creating our Machine Learning Classifiers - Python for Finance 16

-

Testing our Machine Learning Strategy - Python for Finance 17

-

Understanding Leverage - Python for Finance 18

-

Quantopian Pipeline Tutorial Introduction

-

Simple Quantopian Pipeline Strategy