Labeling data part 2

With machine learning, everything tends to boil down to features and labels. We have labels, like, in our case, under-performer, and out-performer. With those labels, we have "features" that are the specific values like Debt/Equity ratio that correspond to that label.

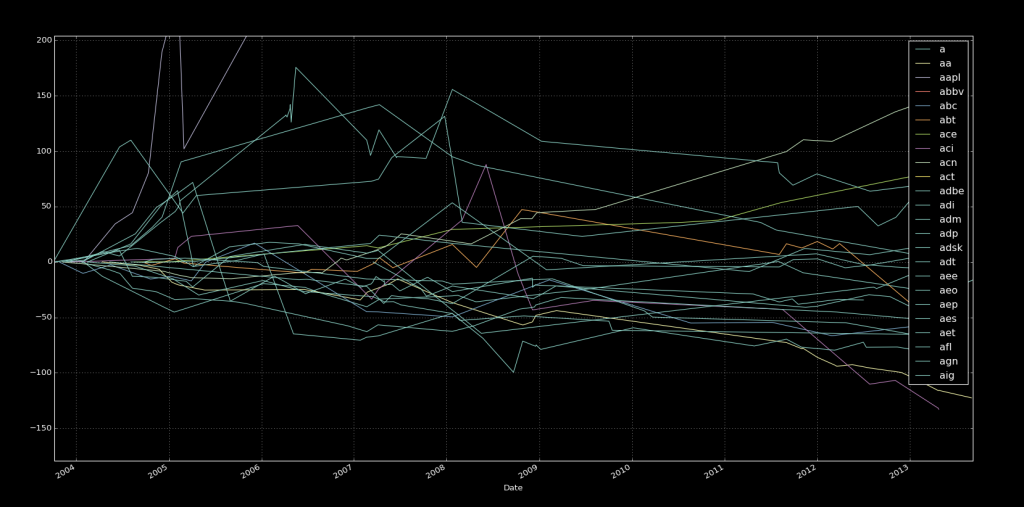

With that, we're looking to now label our data. To do that, we're going to compare the stock's percentage change to the S&P 500's percentage change. If the stock's percent change is less than the S&P 500, then the stock is and under-performing stock. If the percentage change is more, than the label is out-perform.

To do this, we need the calculate percentage change and compare them. Let's cover that:

import pandas as pd

import os

import time

from datetime import datetime

path = "X:/Backups/intraQuarter"

def Key_Stats(gather="Total Debt/Equity (mrq)"):

statspath = path+'/_KeyStats'

stock_list = [x[0] for x in os.walk(statspath)]

df = pd.DataFrame(columns = ['Date',

'Unix',

'Ticker',

'DE Ratio',

'Price',

'stock_p_change',

'SP500',

'sp500_p_change'])

Notice the new changes to our Data Frame.

Next:

sp500_df = pd.DataFrame.from_csv("YAHOO-INDEX_GSPC.csv")

ticker_list = []

for each_dir in stock_list[1:25]:

each_file = os.listdir(each_dir)

ticker = each_dir.split("\\")[1]

ticker_list.append(ticker)

starting_stock_value = False

starting_sp500_value = False

Notice the starting_stock_value and the matching sp500 version. The reason for this is that, as we go, we want to calculate % change. That said, we need to start over with the % change each time the stock itself changes. To handle for this, we set these values.

Next:

if len(each_file) > 0:

for file in each_file:

date_stamp = datetime.strptime(file, '%Y%m%d%H%M%S.html')

unix_time = time.mktime(date_stamp.timetuple())

full_file_path = each_dir+'/'+file

source = open(full_file_path,'r').read()

try:

value = float(source.split(gather+':</td><td class="yfnc_tabledata1">')[1].split('</td>')[0])

try:

sp500_date = datetime.fromtimestamp(unix_time).strftime('%Y-%m-%d')

row = sp500_df[(sp500_df.index == sp500_date)]

sp500_value = float(row["Adjusted Close"])

except:

sp500_date = datetime.fromtimestamp(unix_time-259200).strftime('%Y-%m-%d')

row = sp500_df[(sp500_df.index == sp500_date)]

sp500_value = float(row["Adjusted Close"])

stock_price = float(source.split('</small><big><b>')[1].split('</b></big>')[0])

#print("stock_price:",stock_price,"ticker:", ticker)

if not starting_stock_value:

starting_stock_value = stock_price

if not starting_sp500_value:

starting_sp500_value = sp500_value

So now we set the starting value if we don't have one. From here, we then just need to calculate % change (new-old)/old * 100:

stock_p_change = ((stock_price - starting_stock_value) / starting_stock_value) * 100

sp500_p_change = ((sp500_value - starting_sp500_value) / starting_sp500_value) * 100

Now we just round off the script with the previously covered code:

df = df.append({'Date':date_stamp,

'Unix':unix_time,

'Ticker':ticker,

'DE Ratio':value,

'Price':stock_price,

'stock_p_change':stock_p_change,

'SP500':sp500_value,

'sp500_p_change':sp500_p_change}, ignore_index = True)

except Exception as e:

pass

#print(str(e))

save = gather.replace(' ','').replace(')','').replace('(','').replace('/','')+('.csv')

print(save)

df.to_csv(save)

Key_Stats()

There exists 1 quiz/question(s) for this tutorial. for access to these, video downloads, and no ads.

-

Intro to Machine Learning with Scikit Learn and Python

-

Simple Support Vector Machine (SVM) example with character recognition

-

Our Method and where we will be getting our Data

-

Parsing data

-

More Parsing

-

Structuring data with Pandas

-

Getting more data and meshing data sets

-

Labeling of data part 1

-

Labeling data part 2

-

Finally finishing up the labeling

-

Linear SVC Machine learning SVM example with Python

-

Getting more features from our data

-

Linear SVC machine learning and testing our data

-

Scaling, Normalizing, and machine learning with many features

-

Shuffling our data to solve a learning issue

-

Using Quandl for more data

-

Improving our Analysis with a more accurate measure of performance in relation to fundamentals

-

Learning and Testing our Machine learning algorithm

-

More testing, this time including N/A data

-

Back-testing the strategy

-

Pulling current data from Yahoo

-

Building our New Data-set

-

Searching for investment suggestions

-

Raising investment requirement standards

-

Testing raised standards

-

Streamlining the changing of standards